Hey there!

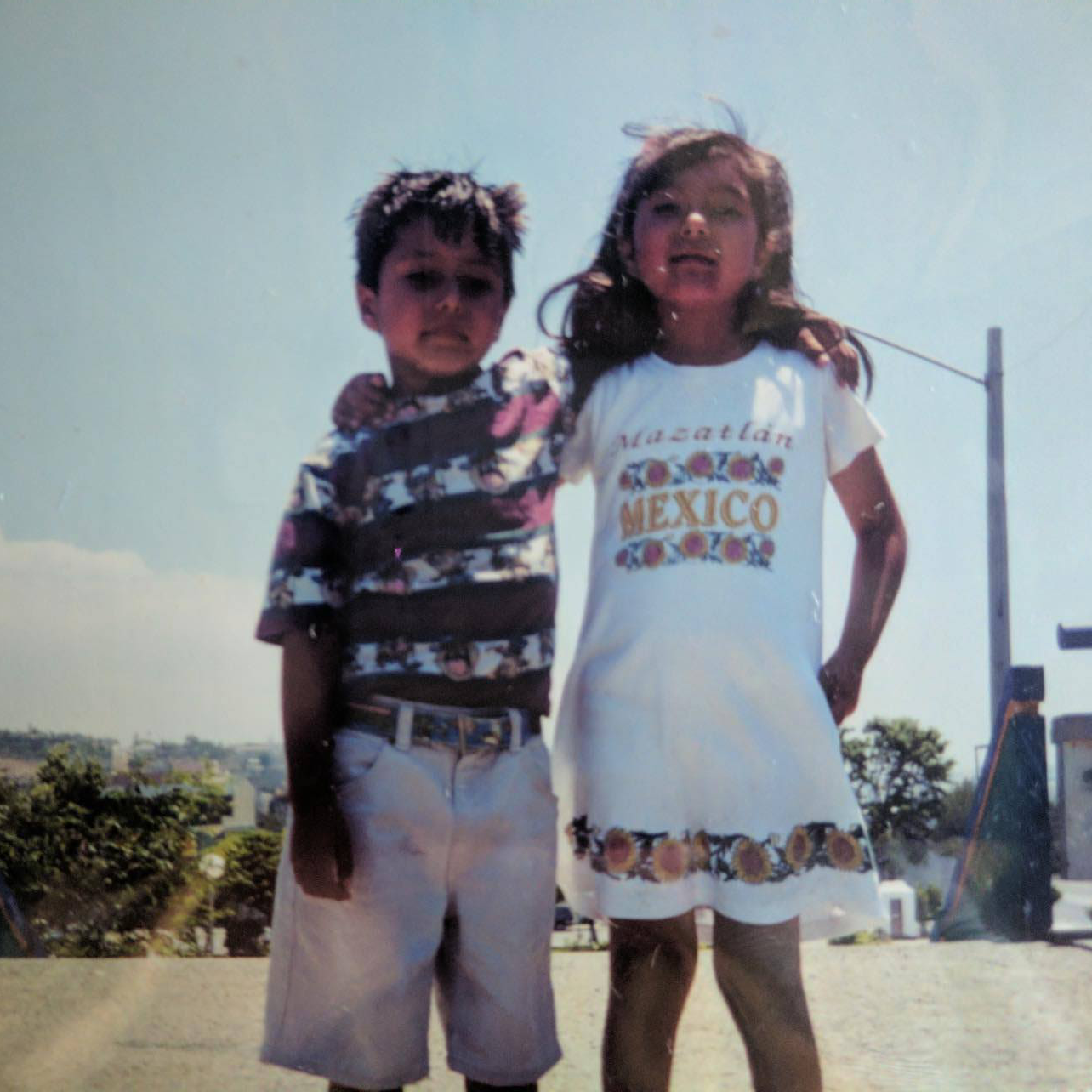

As first-gen Latine siblings who know what it’s like to grow up in poverty and face systemic racism daily, we are more than ready to roll up our sleeves to fight for you.

As low-income immigrants who grew up in Tijuana, Los Angeles, and Nashville, we lived in really poor housing conditions and our parents lived to simply survive—our dad worked long hours in different low-paying, challenging, blue collar jobs. At one point, he was supporting a family of eight in Los Angeles with a salary of only $17,500/year. Our mom, on the other hand, was charged with leading a household in a very challenging context.

Needless to say, we did not grow up with any financial security or literacy. What we did gain from observing our parents’ financial struggles and growing up extremely low-income, however, was a deep determination to escape poverty.

After escaping poverty and amassing over $600,000 in wealth, we are now determined to help others like us reach financial security and improve our relationships with money.

Being the only Latina in her Master in Finance program led Sunem to become increasingly frustrated with how inaccessible wealth building is for communities of color, especially for women and femmes of color. Sunem has been able to channel this frustration by building wealth herself as a woman of color and by also educating her family on how to build wealth.

Now, she’s committed to helping other women of color build strong financial foundations.

Within the first two months into the school year of his first year of teaching, Israel had quit. As a result, he stopped teaching 125 precious and brilliant Black and brown students who may never have an openly queer, brown teacher again. In addition to ceasing being Mr. Tovar, Israel had also lost his only stable source of income. As a first-generation college graduate, being pushed out of the classroom had put him in a precarious economic position.

Being in this challenging financial situation, coupled with the cruel realization that he lacked financial literacy and any form of real wealth even though he was a Yale and Stanford graduate, pushed him to develop a firm commitment to building a strong financial foundation.